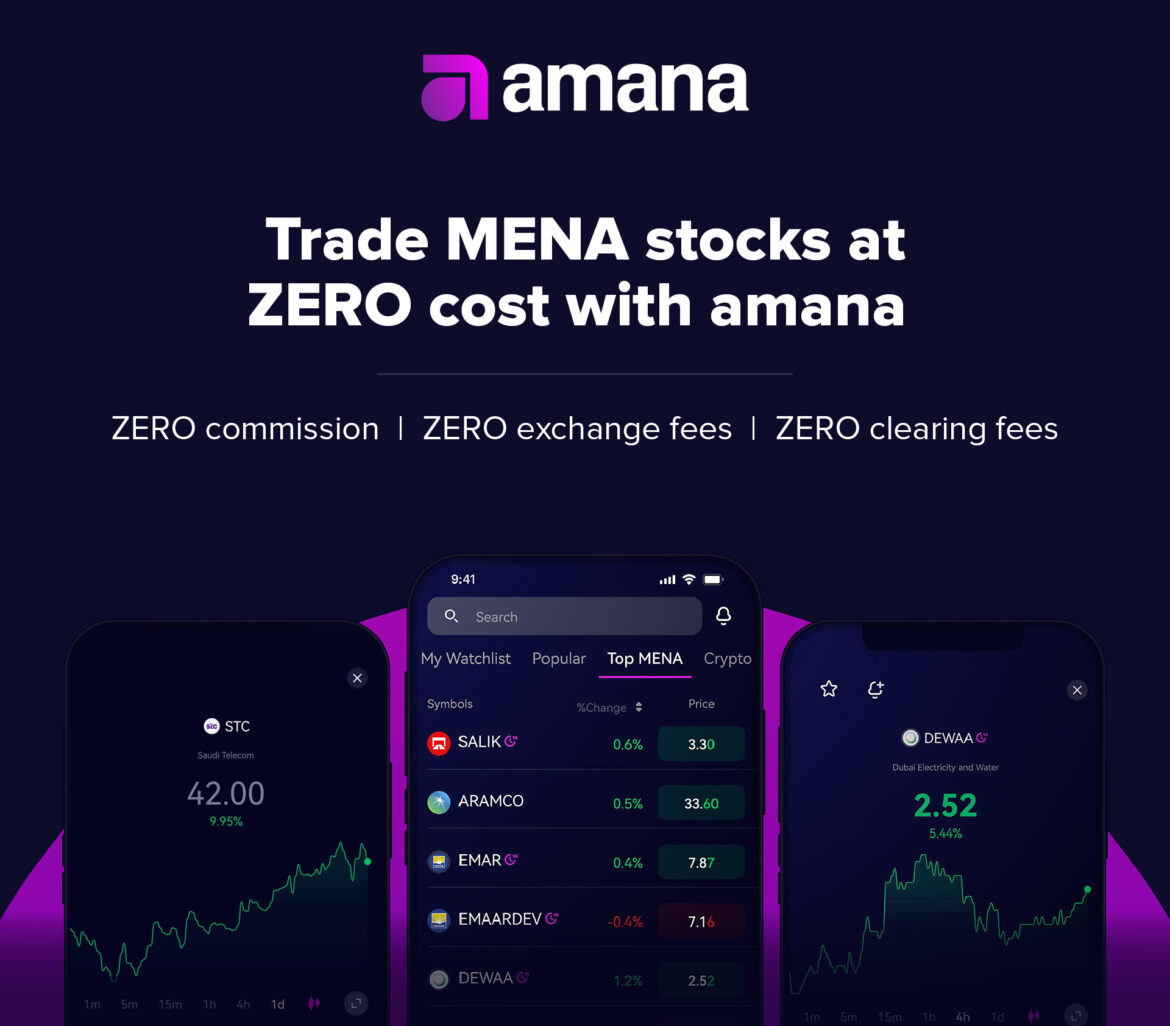

Leading neobroker amana has launched a competitive pricing strategy to shake up the Middle East’s financial markets. Customers can now benefit from commission-free, zero-fee pricing on MENA stock trades in a bold move poised to offer investors and traders unparalleled access and affordability to the region’s stock markets.

This approach, inspired by the success of commission-free models in USA and UK, where pioneering brokers like Robinhood attracted more new clients than Interactive Brokers, TD Ameritrade, and E-trade combined within five years of launch, reflects amana’s commitment to reducing barriers to the financial system in MENA.

Over 1,000 companies are listed in MENA, with an estimated capitalization of $4 trillion. The region has also led the way globally in terms of IPOs, attracting impressive investor demand at sky-high oversubscription levels. Yet, only about 5% of the region’s population participates in the stock market, a stark contrast to the active and broad participation in USA (58%) or UK (33%).

“Our initiative will provide more investors and traders across MENA access to local equity markets – in a cost-effective, fractionalized method, for everyone. We believe the MENA opportunity is big, and everyone should be able to participate in that growth opportunity,” said Muhammad Rasoul, CEO of amana.

amana’s new pricing strategy, following its earlier initiative to offer fractional MENA shares, aims to enhance inclusivity even further.

“This move exemplifies amana’s core values. As a locally built broker, our mission extends beyond being a part of this emerging region’s growth; it’s about ensuring that as many people as possible can share in the economic potential of this once-in-a-generation regional transformation.”

Beyond local stocks, amana also offers customers commission-free trading on all asset classes, including US stocks, indices, commodities, gold, currencies, crypto and more. amana is the first MENA broker to offer all assets from a single account.